Mortgage rates are one of the most powerful forces shaping the U.S. housing market. Even small changes in interest rates can significantly affect affordability, buyer demand, home prices, and overall sales activity. In 2025–2026, mortgage rate movements continue to influence whether the market favors buyers, sellers, or remains balanced.

Understanding how mortgage rates impact home sales helps buyers plan purchases, sellers time listings, and investors assess risk.

What Are Mortgage Rates?

A mortgage rate is the interest charged on a home loan. In the United States, the most common loan type is the 30-year fixed-rate mortgage, which locks in the interest rate for the life of the loan.

Mortgage rates are influenced by:

Federal Reserve policy

Inflation trends

Bond market yields

Economic growth

Global financial conditions

When rates rise, borrowing becomes more expensive. When rates fall, borrowing becomes cheaper — directly affecting housing affordability.

The Affordability Connection

Mortgage rates directly impact monthly payments. Even a small increase can significantly change what buyers can afford.

For example:

If a buyer qualifies for a $400,000 loan at 6% interest, their monthly payment will be considerably lower than the same loan at 7%. That 1% difference can add hundreds of dollars per month.

Higher rates reduce purchasing power. Buyers either:

Lower their budget

Choose smaller homes

Move to more affordable areas

Delay buying altogether

As affordability tightens, home sales activity often slows.

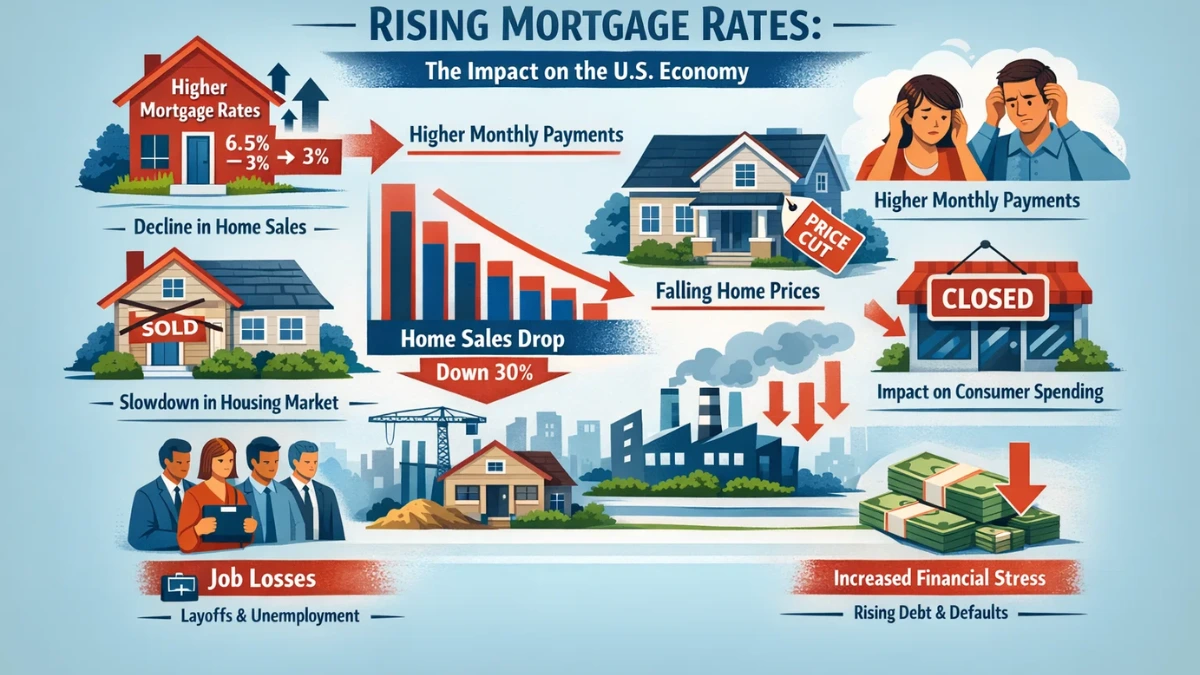

Rising Mortgage Rates and Home Sales

When mortgage rates rise:

Buyer demand typically softens.

Home sales volume often declines.

Homes may stay on the market longer.

Price growth slows.

Higher rates create caution among buyers, especially first-time buyers who are more sensitive to monthly payment increases.

Additionally, higher rates can create a psychological barrier. Buyers may wait in hopes that rates fall, leading to reduced transaction volume.

Falling Mortgage Rates and Home Sales

When mortgage rates decline:

Buyer affordability improves.

Pent-up demand re-enters the market.

Sales activity increases.

Competition may intensify.

Lower rates often trigger renewed buyer confidence. Even a modest rate drop can unlock sidelined demand and boost transaction volume.

However, falling rates can also increase competition, sometimes pushing home prices upward if inventory remains limited.

The “Lock-In Effect”

One major way mortgage rates influence home sales is through the lock-in effect.

Many homeowners secured ultra-low mortgage rates in 2020–2022. If they sell their home today, they would likely have to take on a higher rate for a new property.

As a result, many choose not to move. This reduces housing inventory, limiting resale listings and keeping supply tight.

The lock-in effect slows both selling and buying activity, contributing to lower overall transaction volume even when demand exists.

Impact on First-Time Buyers

First-time buyers are especially sensitive to rate changes.

Unlike existing homeowners who may have equity to roll into a new purchase, first-time buyers depend heavily on financing. Higher mortgage rates can push them out of qualification range or increase required income levels.

When rates rise sharply, entry-level home sales often decline first.

When rates stabilize or drop, first-time buyer activity tends to rebound quickly.

Builder Incentives and New Home Sales

Mortgage rates also influence new construction sales.

When rates are high, homebuilders often offer:

Rate buydowns

Closing cost assistance

Price incentives

These strategies help offset higher borrowing costs and keep sales momentum steady.

In some periods, new home sales outperform existing home sales because builders can offer financial incentives that private sellers cannot.

Investor Activity and Mortgage Rates

Mortgage rates also affect real estate investors.

Higher borrowing costs reduce investment margins and may slow investor purchases. Lower rates improve cash flow potential and increase investor demand.

Institutional investors, in particular, closely monitor financing conditions when expanding rental portfolios.

Broader Economic Impact

Mortgage rates reflect broader economic conditions.

If rates rise due to strong economic growth, job security and income gains may offset affordability concerns.

If rates rise due to inflation concerns or financial instability, buyer confidence may weaken, leading to slower home sales.

The housing market does not operate in isolation — mortgage rates are tied to larger economic forces.

Regional Differences

The impact of mortgage rates varies by region.

High-cost markets are often more sensitive to rate increases because loan amounts are larger.

More affordable regions may experience less dramatic slowdowns, as lower home prices help offset higher rates.

Local inventory conditions also influence how strongly rates affect sales activity.

2026 Outlook

In 2026, mortgage rates remain one of the most closely watched housing indicators.

If rates stabilize or gradually decline, home sales could increase moderately as buyer confidence improves.

If rates remain elevated, sales volume may stay below long-term historical averages, though limited inventory could continue supporting price stability.

The balance between rates, inventory, and buyer demand will determine the pace of home sales growth.

Conclusion

Mortgage rates play a central role in shaping U.S. home sales. Rising rates reduce affordability and slow transaction volume, while falling rates stimulate demand and increase activity.

Beyond affordability, rates influence inventory through the lock-in effect, affect first-time buyers disproportionately, and shape investor behavior.

In today’s market, monitoring mortgage rate trends is essential for anyone involved in buying, selling, or investing in real estate. Even small changes can ripple across the housing market, impacting sales, prices, and overall momentum.