The U.S. housing market in 2026 continues to evolve amid shifting economic conditions, mortgage rate changes, and demographic trends. While home sales have faced affordability pressures and limited inventory, key statistical patterns reveal where demand persists, how buyer behavior has shifted, and what trends are shaping the market this year.

This analysis highlights the most important home sales statistics for 2026, offering insights that buyers, sellers, investors, and industry observers should know.

1. Annual Home Sales Volume

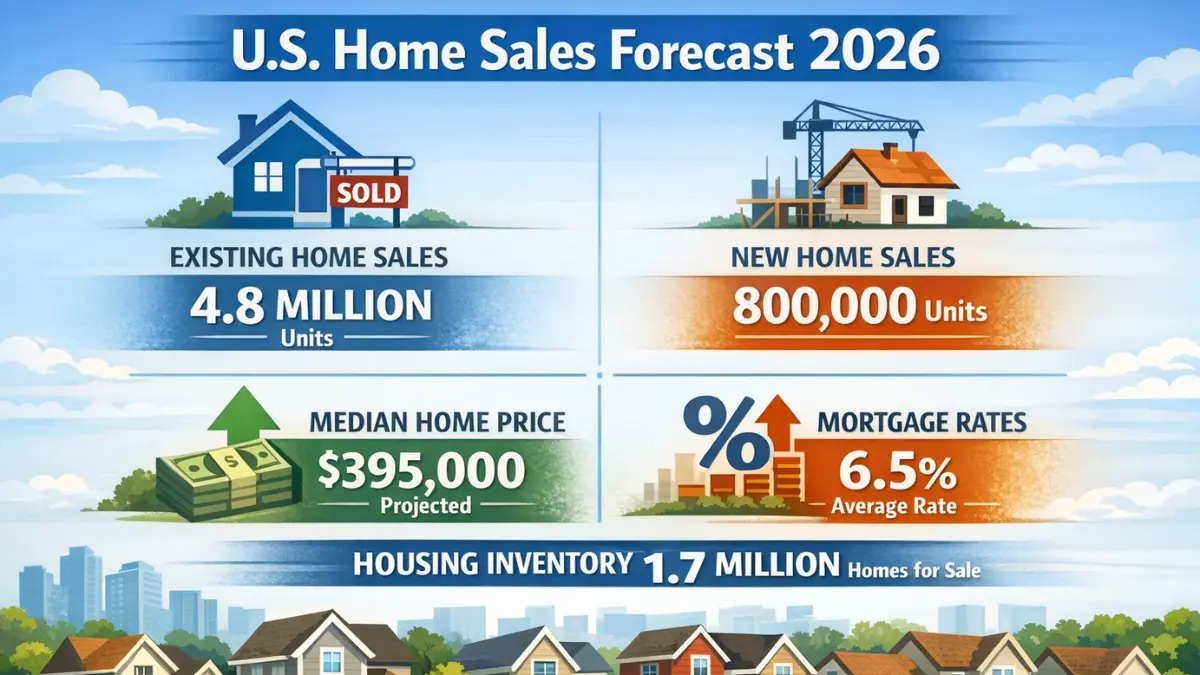

In 2026, total existing home sales remain moderate compared to historical averages — generally below pre-pandemic peaks but steady in comparison to recent years.

Home sales volumes are influenced by:

• Mortgage rate stability

• Inventory availability

• Buyer demand dynamics

• Regional economic conditions

Lower overall transaction counts reflect ongoing affordability pressures, especially in high-cost coastal markets.

2. Median Home Prices

Median home prices across the U.S. continue to show moderate year-over-year growth in 2026.

Key price observations:

• Price growth is generally in the low single digits nationally.

• Affordable and mid-priced segments tend to see stronger demand.

• High-cost coastal regions show slower appreciation due to affordability limits.

Limited inventory continues to support price resilience, preventing widespread declines even in markets with weaker demand.

3. Regional Variations in Sales and Prices

Home sales performance varies significantly by region:

Sun Belt States:

States such as Texas, Florida, and North Carolina report stronger sales activity and above-average price appreciation. These markets benefit from job growth, lower cost of living, and inbound migration trends.

Midwestern Markets:

Cities in the Midwest often see stable sales and moderate price growth, driven by affordability and local employment stability.

High-Cost Coastal Markets:

Areas like California and parts of the Northeast typically show slower sales growth, as affordability pressures constrain buyer activity.

Regional differences highlight how local economic conditions influence home sales trends.

4. New vs. Existing Home Sales

In 2026, the split between new and existing home sales remains meaningful:

• Existing home sales continue to dominate total volumes, representing the majority of transactions.

• New home sales have gained relevance as builders address supply shortages and offer incentives such as rate buydowns or flexible financing options.

Builders often focus on entry-level communities and suburban growth areas to capture first-time buyer demand.

5. Days on Market (DOM) Trends

Days on Market — a key indicator of sales velocity — varies by market:

• Affordable homes in high-demand regions often sell quickly (shorter DOM).

• Higher-priced homes in slower markets may take longer to sell.

Lower inventory in desirable price segments contributes to faster sales, while higher inventory in select regions can lead to slower turnover.

6. Buyer Type Statistics

The composition of buyers in 2026 includes:

First-Time Buyers:

Remains a key segment, though affordability concerns continue to limit participation in some markets.

Move-Up Buyers:

Move-up buyers are active but sensitive to mortgage rates and equity positions in existing homes.

Investor Purchases:

Investor and institutional purchases remain present but moderate compared to earlier boom phases.

Understanding buyer mix helps interpret sales trends by price segment and region.

7. Mortgage Rate Impact on Sales

Mortgage rate movements continue to influence purchase decisions:

• Rate stability supports moderate sales activity.

• Rate volatility can delay buyer entry and reduce turnover.

Even modest rate increases or decreases significantly influence monthly payment affordability and buyer psychology.

8. Price Tier Dynamics

Sales trends differ by price tier:

Entry-Level Homes:

High competition and limited supply often characterize this segment. Demand can outpace inventory, leading to stable pricing.

Mid-Market Homes:

Consistent buyer interest — especially from first-time and move-up buyers — supports ongoing sales activity.

Luxury Segment:

Sales vary by region. In high income and lifestyle markets, luxury homes continue to see sustained interest, albeit with slower velocity compared to more affordable tiers.

9. Inventory Levels and Sales Correlation

Housing inventory — measured as months of supply — remains a central factor:

• Lower months-of-supply correlates with faster sales and price resilience.

• Higher inventory in select markets correlates with slower turnover and greater price negotiation.

Balanced markets — with 5–6 months of supply — are rare, as most regions remain either tighter (favoring sellers) or slowly trending toward balance.

10. Outlook and 2026 Expectations

Key statistical expectations for the remainder of 2026 include:

• Moderate home price appreciation, supported by constrained inventory

• Stable but below-peak sales volumes

• Regional divergence, with Sun Belt markets leading growth

• First-time buyer participation increasing if mortgage rates stabilize or ease

• New construction sales growth, as builders address supply gaps

These statistics suggest a housing market that’s evolving toward greater balance, but one still shaped heavily by supply constraints and affordability dynamics.

Conclusion

The U.S. home sales statistics for 2026 paint a picture of a market in gradual adjustment. While sales volumes remain moderate and affordability pressures persist, home prices continue to hold up — supported by limited inventory and strong demand in key regions.

For buyers, sellers, and investors, understanding these data points — from regional performance to buyer composition and price tier trends — is critical to navigating the housing landscape in 2026.