The U.S. housing market has experienced significant shifts over the past several years, driven by economic changes, demographic trends, and evolving buyer preferences. While home price growth moderated after peaking earlier in the decade, the market continues to reflect strong demand, limited supply, and broader macroeconomic influences. Understanding what drives U.S. home prices in 2025–2026 provides insights into pricing dynamics, regional variations, and future expectations.

1. Supply and Demand Dynamics

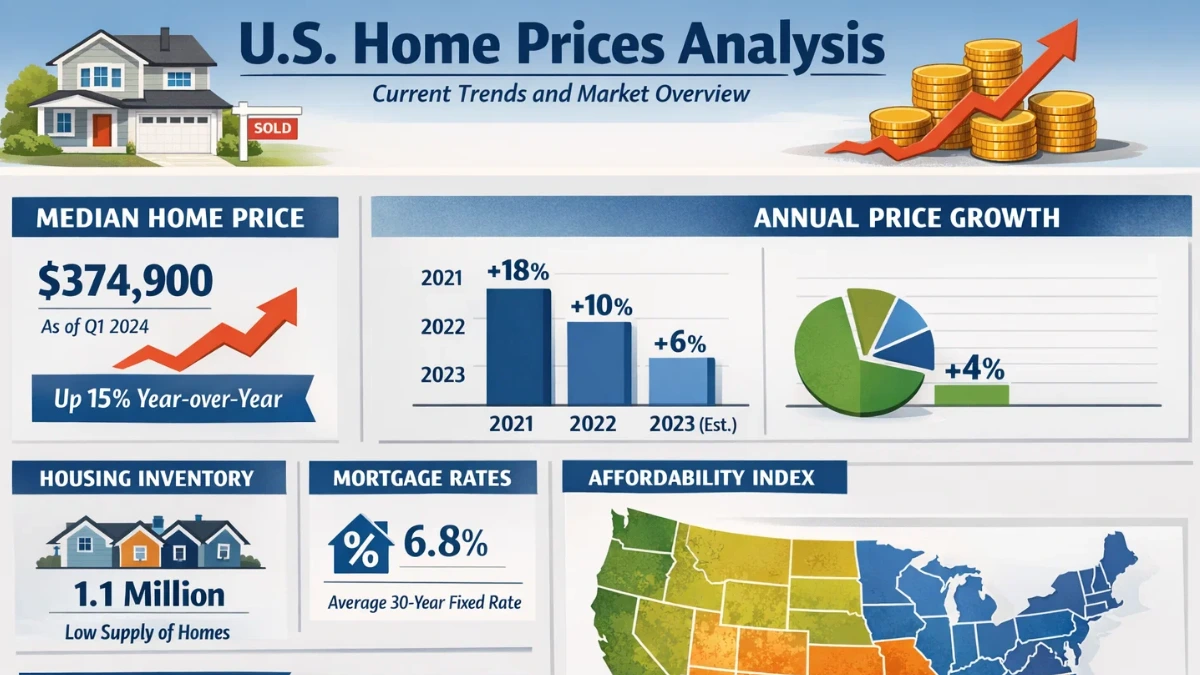

At the core of any real estate market is the balance between supply and demand. In the U.S., limited housing inventory is one of the strongest drivers of price resilience.

Low available inventory:

Homeowners who secured historically low mortgage rates in previous years have often opted not to sell, reducing the number of listings available for buyers. This constraint on supply pushes buyers into competition for the limited homes on the market, increasing price pressure.

Demand from buyers:

Despite higher mortgage rates compared to pre-pandemic levels, demand remains robust. Millennials — the largest generational cohort — continue to enter peak homebuying years, fueling demand for starter homes, suburban properties, and move-up purchases.

These combined supply constraints and sustained demand elevate price competition, even in periods of slower economic growth.

2. Mortgage Rates and Financing Costs

Mortgage rates have a direct influence on affordability and therefore home prices.

Interest rate sensitivity:

Higher mortgage rates reduce borrowing power, meaning prospective buyers qualify for smaller loans or opt for less expensive homes. This can put a damper on price growth in certain markets, especially at the entry level.

Rate stabilization effects:

In a 2026 context, slight stabilization or modest declines in mortgage rates — if achieved — could boost affordability and buyer confidence, increasing demand in markets where rates are a key deciding factor. Even a 0.5% shift in the average mortgage rate can materially influence a buyer’s monthly payment and housing budget.

3. Regional Market Variations

Real estate is inherently local, and national figures often mask stark differences across regions.

High-growth markets:

Cities in the Sun Belt region — including portions of Texas, Florida, Arizona, and the Carolinas — have seen robust demand due to lower cost of living, population growth, and job expansion. Strong inbound migration contributes to price strength in these areas.

Muted growth markets:

Some high-cost coastal markets — such as parts of California and the Northeast — may experience slower price growth due to affordability pressures. Buyers may prioritize moving to more affordable regions, shifting demand dynamics.

Midwest and secondary cities:

More affordable cities in the Midwest have seen steady price increases due to increased demand from buyers seeking value.

This regional disparity highlights how local employment trends, migration patterns, and economic conditions shape home pricing.

4. Economic and Employment Trends

Home prices are closely linked to broader macroeconomic indicators.

Employment levels:

Strong employment generally supports housing demand. As long as job creation remains positive and wages grow, more households can afford homeownership, supporting price stability.

Income growth vs. affordability:

While wage growth helps support higher prices, the pace of home price appreciation often outpaces income growth, especially in high-demand regions. This gap can constrain affordability and temper price increases.

5. Construction Activity and New Supply

The pace of housing construction plays a critical role in price trends.

Underbuilding impacts:

Decades of underbuilding relative to household formation have left underlying supply deficits. When demand consistently outstrips new supply, upward price pressure persists.

Builder incentives and product mix:

Homebuilders often focus on higher-margin segments due to higher material and labor costs. This leads to a supply skew toward larger or premium homes, limiting options in the entry-level segment where much of the demand is concentrated.

If new construction accelerates meaningfully — particularly in affordable segments — it could ease price pressure over time.

6. Investor Activity and Rental Demand

Investor participation also influences pricing dynamics.

Institutional investors:

Large institutional investors have increased their presence in single-family rentals and multifamily properties, particularly in high-growth metros. Their activity can reduce resale inventory and support price appreciation.

Rental market pressure:

High rental rates often push renters to consider homeownership, adding to buyer demand in certain segments. Strong rental markets also make housing purchases more attractive from a long-term investment perspective.

7. Demographics and Lifestyle Preferences

Demographic trends continue to shape housing demand.

Millennials and Generation Z:

As Millennials enter prime homebuying years and Generation Z begins purchasing homes, demand is broadening. This generational shift fuels sustained interest across various price segments.

Remote and hybrid work:

Work-from-home trends have reshaped location preferences. Many buyers prioritize larger homes, flexible workspace, and suburban or exurban living, reinforcing demand in markets that offer space and affordability.

8. Policy and Regulatory Influences

Government policies, zoning rules, and tax structures influence home prices indirectly.

Local zoning and land-use regulations:

Strict zoning can constrain new supply, particularly in urban cores. Loosening restrictions or adopting more flexible land-use policies could increase supply and improve affordability over time.

Tax incentives:

Property tax structures and homeownership incentives can influence buyer behavior. While tax policy has a limited short-term effect on pricing, it contributes to long-term investment decisions.

Conclusion

U.S. home prices in 2025–2026 are driven by a complex interplay of supply constraints, mortgage rate dynamics, regional demand, demographic shifts, and broader economic conditions. Limited housing inventory continues to support pricing strength, while financing costs and affordability pressures influence buyer decisions.

Regional variations underscore the importance of local conditions — from high-growth Sun Belt markets to more price-constrained coastal regions. Ultimately, understanding what drives home prices requires a holistic view of economic trends, buyer behavior, and supply-side developments.

For buyers, sellers, and investors alike, staying informed on mortgage rate trends, regional economic indicators, and inventory changes will be key to navigating the housing market environment in 2026.